30+ Mortgage calculator with taxes

15-Year Fixed Rate Mortgage - A home loan paid over a term of 15 years. Recast your mortgage.

Yea Bmore Personal Finance Personal Finance Infographic Finance Infographic

A 225000 loan amount with a 30-yea r term at an interest rate of 3875 with a down-payment of 20 would result in an estimated principal and interest monthly payment of over the full term of the loan with an.

. Interest rates in the calculator include APR which estimates closing costs and fees and is the actual cost of borrowing. Based on term of your mortgage interest rate loan amount annual taxes and annual insurance calculate your monthly payments. Mortgages are how most people are able to own homes in the US.

Your mortgage payment includes your principal and interest down payment loan term homeowners insurance property taxes and HOA feesThis gives you the ability to compare a number of different home loan scenarios and how it will impact your budget. Estimate the cost of 30 year fixed and 15 year fixed mortgages. Here is where you enter the additional costs that are typically billed as part of your monthly mortgage.

With a 30-year fixed-rate mortgage you have a lower monthly payment but youll pay more in interest over time. Deduction for state and local taxes paid. Of course mortgage regulations changes from province to province so its crucial that the mortgage calculator you use is specific to where you live.

It will have a lower monthly payment but a. See how changes affect your monthly payment. Interest rates in the calculator are for educational purposes only and your interest rate may differ.

It also calculates the sum total of all payments including one-time down payment total PITI amount and total HOA fees during the entire amortization. How to Pay Off a 30-Year Mortgage Faster. At the bottom of each calculator is a button to create printable amortization schedules which enable you to see month-by-month information for each loan throughout.

See your total mortgage payment including taxes insurance and PMI. Use this free Georgia Mortgage Calculator to estimate your monthly payment including taxes homeowner insurance principal and interest. Calculate total monthly mortgage payments on your home with taxes and insurance.

Most mortgages have a loan term of 30. The loan term is the length of your mortgage. The loan is secured on the borrowers property through a process.

Loan term is the length you wish to borrow - typically 15 or 30. Surveys title search and insurance recording fees mortgage taxes and credit background checks. Use this mortgage calculator to estimate how much house you can afford.

Once the loan term is up your mortgage should be paid off. Use SmartAssets free California mortgage loan calculator to determine your monthly payments including PMI homeowners insurance taxes interest and more. The most common loan terms are 30-year fixed-rate mortgages and 15-year fixed-rate mortgagesDepending on your financial situation one term may be better for you than the other.

You can view current VA mortgage rates here. Pop up mortgage calculator. There are a few ways to pay off a mortgage sooner than the 30-year term.

A mortgage loan or simply mortgage ˈ m ɔːr ɡ ɪ dʒ in civil law jurisdicions known also as a hypothec loan is a loan used either by purchasers of real property to raise funds to buy real estate or by existing property owners to raise funds for any purpose while putting a lien on the property being mortgaged. By default 250000 30-yr fixed-rate loans are displayed in the table below. Estimate your payment with our easy-to-use loan calculator.

The most common mortgage loan is the conventional 30-year fixed-interest loan which represents 70 to 90 of all mortgages. Bi-weekly payments instead of monthly payments. Pay extra each month.

30-year fixed is the most common mortgage type. Making one additional monthly payment each year. Here are some of the common loan terms entered into the calculator.

Then get pre-qualified to buy by a local lender. Account for interest rates and break down payments in an easy to use amortization schedule. Choose mortgage calculations for any number of years months amount and interest rate.

A mortgage calculator is a smart first step to buying a home because it breaks down a home loan into monthly house payments based on a propertys price current interest rates and other factors. How to Use the Mortgage Calculator. Initial mortgage insurance premium MIP Lenders charge an initial and annual MIP which is paid to the FHA.

Refinance with a shorter-term mortgage. Lock-in Redmonds Low 30-Year Mortgage Rates Today. Also known as the SALT deduction it allows taxpayers to deduct up to 10000 of any state and local property taxes plus either their state and local income taxes or sales taxes.

Compare lenders serving Redmond to find the best loan to fit your needs lock in low rates today. A mortgage calculator gives you valuable insight into what your regular payments and amortization sschedule will be in different scenarios eg different mortgage amounts different rates etc. How much money could you save.

We have spent considerable amount of time over the last 30 days including we locked ourselves. We offer a number of calculators that makes it easy to compare 2 terms side-by-side for all the common fixed-rate terms. You can adjust your monthly.

Free mortgage calculator to find monthly payment total home ownership cost and amortization schedule with options for taxes PMI HOA and early payoff. 10 or 15 10 or 20 10 or 30 15 or 20 15 or 30 20 or 30. Filters enable you to change the loan amount duration or loan type.

We also add in the cost of property taxes mortgage insurance and homeowners fees using loan limits and figures based. Redfins mortgage calculator estimates your monthly mortgage payment based on a number of factors. Mortgage loan terms can vary but most borrowers choose either a fixed-rate 15-year or 30-year mortgage.

Use our free mortgage calculator to estimate your monthly mortgage payments. With a 5 interest rate for 30 years and 45000 5 down requires an annual income of 218403. Options to pay off your mortgage faster include.

This mortgage calculator makes it easy to see how changes in the mortgage rate or the loan amount affect the income required for a loan. Deduction for mortgage interest paid. The calculator takes into account your interest rate length of the loan the amount of time you plan to stay in your home origination and closing costs and taxes so you can get a complete financial.

It will have a higher monthly payment but a lower interest rate than a 30-year mortgage. 30-year fixed-rate mortgage lower your monthly. Estimate your monthly mortgage payments with taxes and insurance by using our free mortgage payment calculator from US.

For instance if you take out a 30-year mortgage that means youll make a monthly payment for 30 years. The above calculator can help you quickly break down your costs and benefits to better understand if refinancing is the right choice for you. This free mortgage calculator lets you estimate your monthly house payment including principal and interest taxes insurance and PMI.

This free mortgage calculator helps you estimate your monthly payment with the principal and interest components property taxes PMI homeowners insurance and HOA fees. Interest paid on the mortgages of up to two homes with it being limited to your first. 30-Year Fixed Rate Mortgage - A home loan paid over a term of 30 years.

Paying loan off faster vs 30-year loans Current avg.

On A 30 Year Fixed Mortgage Would It Be Possible To Make Additional Principle Payments To End Up Paying Interest Equal To A 15 Year Mortgage Quora

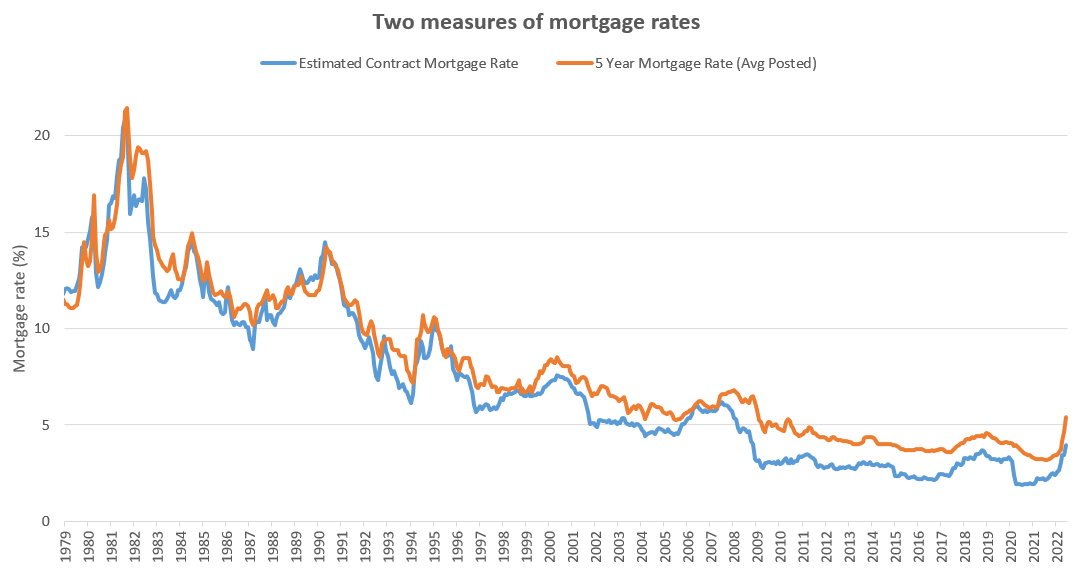

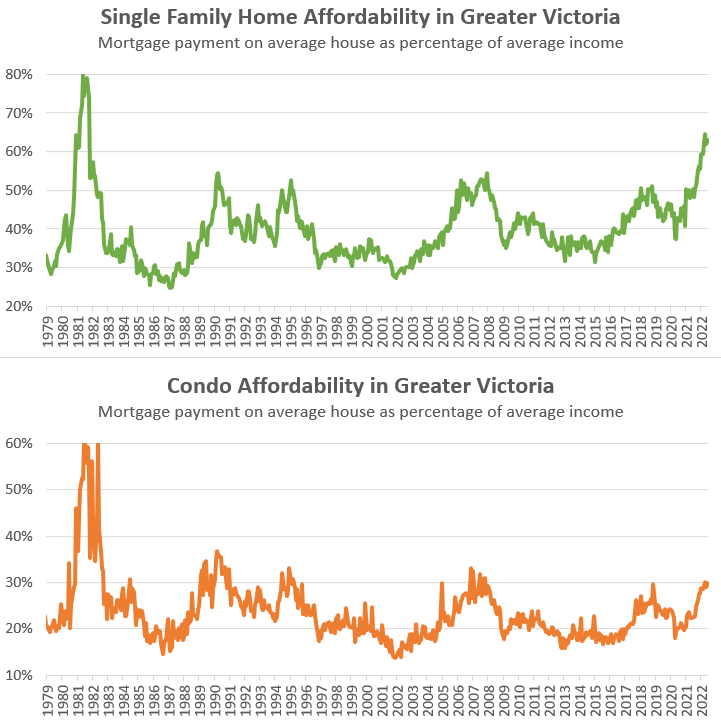

High Frequency Un Affordability House Hunt Victoria

10 Most Successful Real Estate Marketing Strategies Of All Time Brandongaille Co Real Estate Infographic Real Estate Marketing Real Estate Marketing Strategy

A Little Tax Relief For A Favorite Tax Accountant At Tax Time Bravo Baskets Accountant Gifts Client Appreciation Gifts Customer Appreciation Gifts

Pin On Airbnb

On A 30 Year Fixed Mortgage Would It Be Possible To Make Additional Principle Payments To End Up Paying Interest Equal To A 15 Year Mortgage Quora

5 Reasons To Refinance Your Mortgage 6 Costs To Consider Before You Do Lwp Llc

How To Calculate A Tax In Excel Quora

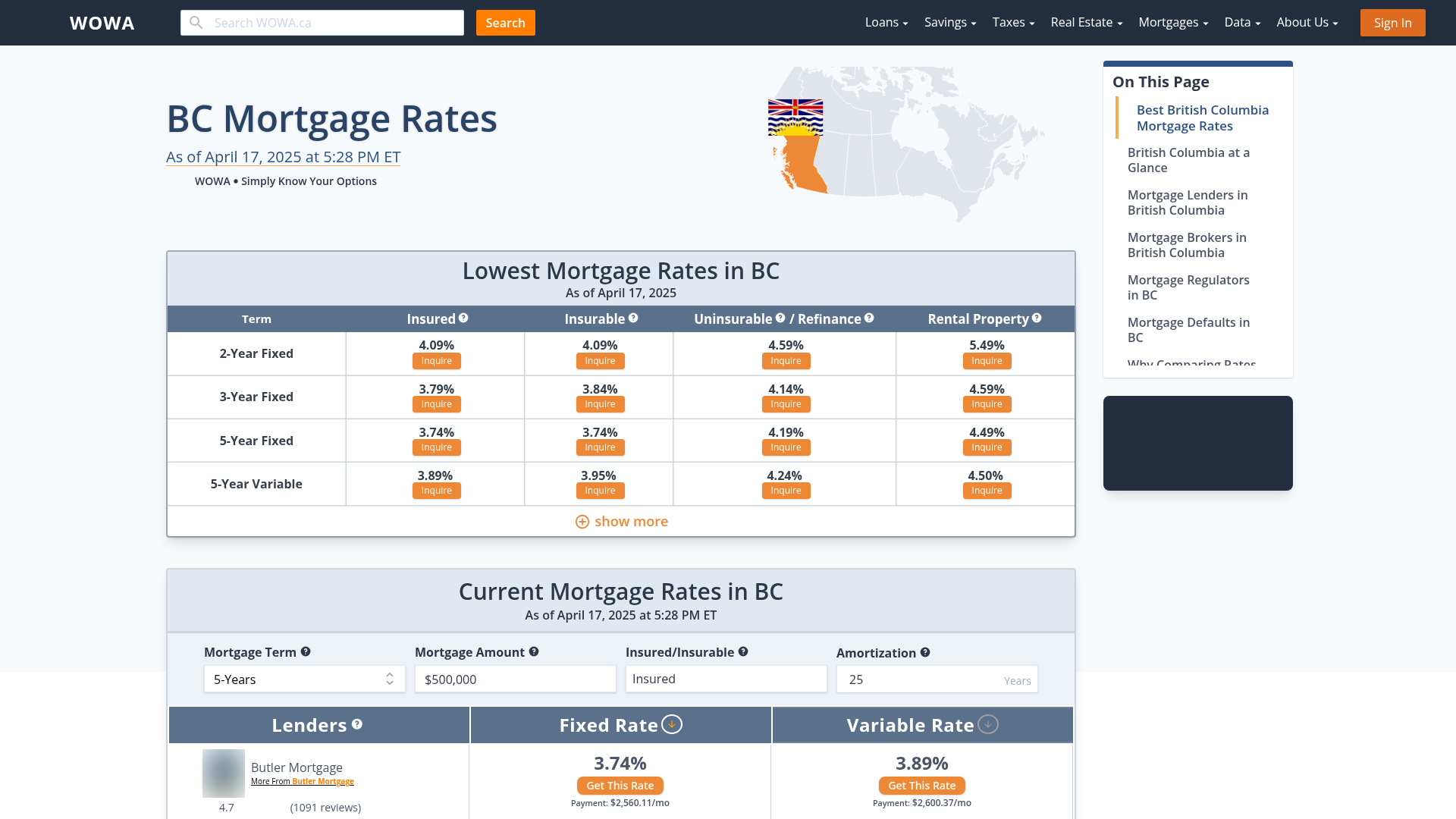

British Columbia Mortgage Rates From 30 Bc Lenders Wowa Ca

:max_bytes(150000):strip_icc()/1040-SR2022-44e2ed8aefeb4c65a07f875e2b3e173f.jpeg)

Form 1040 Sr U S Tax Return For Seniors Definition

Pin On Buying A Home Tips And Guides

High Frequency Un Affordability House Hunt Victoria

10 Million Dollars The Ideal Net Worth Amount For Retirement

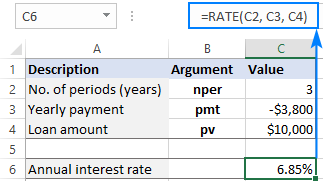

Using Rate Function In Excel To Calculate Interest Rate

What Would My Yearly Salary Have To Be To Afford A 2m House Quora

Best Mortgages In Canada Comparewise

/1040-SR2022-44e2ed8aefeb4c65a07f875e2b3e173f.jpeg)

Form 1040 Sr U S Tax Return For Seniors Definition